Orlando Florida Regional Housing Market Update DECEMBER 2012

ORLANDO FLORIDA

REGIONAL HOUSING MARKET UPDATE

December 2012

The latest housing market data are in for Central Florida, including Lake Mary Florida, Longwood Florida, Sanford Florida, Winter Springs Florida, Oviedo Florida and Altamonte Springs Florida. Here are the highlights taken from the Orlando Realtor Regional Board for

November 2012 (the latest now available):

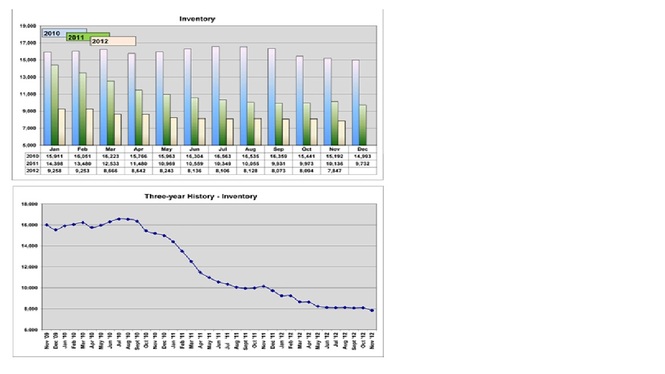

Inventory

After last month’s slight increase, this month brings a pronounced drop in inventory – almost 2.5% of total inventory in one month. Thus, twenty-four out of the last 28 months now have seen Orlando Florida’s regional housing inventory decline. Currently there are now only 7,847 housing units on the market through the Orlando Regional Multiple Listing Service – down from 8,094 last month and down from from 9,258 in January of this year. This includes single family homes, condos, duplexes and townhomes. Last November held an inventory of 10,136. In December of 2008, there were 22,524 on the market. At the very height of inventory in early 2007, there were more than 28,000 homes on the market. The overall inventory is down 22.58% from a year ago.

Single family inventory is down 25.53% from a year ago, but condo inventory is down only 3.71%. The current pace of sales equates to only 3.23 months of supply. Inventory hasn’t been this low since the boom in 2005. Six months of supply is generally considered balanced. Under normal economic conditions, anything above six months is generally considered a buyer’s market and anything below is then considered a seller’s market.

IF YOU ARE LOOKING TO BUY OR SELL YOUR HOME OR PROPERTY – PLEASE CONTACT US AND FIND OUT HOW WE CAN HELP!

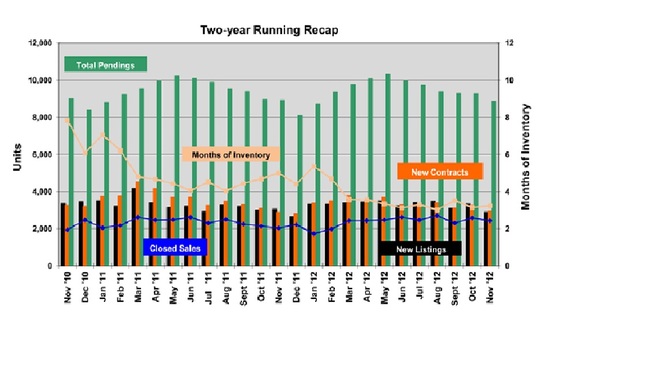

Sales

There were 2,430 closings in November, down slightly from the previous month, but a 19.88% increase from a year ago.

Of the sales in November,1,218 or 50.12% were “normal”, 705 were short sales and 507 were bank-owned. The number of normal sales increased by 50.37% compared to a year ago and the number of short sales fell by 6.62%. This reflects the trend of normal sales increasingly taking more and more of the sales total than those sales under distressed conditions and is the first time that normal sales actually accounted for more sales than distressed sales since the housing market meltdown began.

Single Family Home sales increased by an even larger margin this month – 22.44% over a year ago. Condo sales increased by 22.74% and Townhome & Villa sales increased 1.36% from a year ago.

Homes spent an average of 83 days on the market in November, four days more than last month, but still two weeks less than a year ago. The averagehome sold for 96.27% of its then-current listing price. “Then current listing price” is an important distinction since a home may have been on the market with prior price reductions. Thus, it may have ended up selling for less than the percentage cited from its original debut listing price.

By county in the Orlando MSA for sales compared to a year ago: Seminole County was up 37.68% from last November, Orange County was up 5.80%. Osceola came in up 3.62%, and Lake County increased by 27.78%. No statistics for Volusia or Brevard were made available (Volusia has several different realtor boards with both New Smyrna and Daytona each having their own and Volusia is officially part of the Daytona Beach MSA. In addition, Brevard has its own Board).

IF YOU ARE LOOKING TO BUY OR SELL YOUR HOME OR PROPERTY – PLEASE CONTACT US AND FIND OUT HOW WE CAN HELP!

Prices

The median price of an existing home was up 12.17% in November 2012 from a year ago to $129,000. The Orlando Florida metro area market has now posted positive year-over-year gains in price for 16 consecutive months.

However, remember - the median price above encompasses all sales. Individual categories can fluctuate within the median. However, this month, as was the case last month, prices rose in all categories. Normal sales rose 4.76%, short sales rose 4.67% and Bank-Owned averages increased 12.43% compared to a year ago.

Overall prices have risen by 19% since January of this year and 36% since January of 2011.

Affordability

The Orlando MSA affordability index decreased to 247 and the first time homebuyer’s index also decreased to 175.

Each index is inversely proportional to pricing changes. An affordability index of 100 means that a buyer earning the state-reported median income has exactly the income necessary to purchase the median-priced home. Anything over 100 indicates that buyers have more income than that which is required. A score of 99 means the buyer is 1 percent short of the income necessary to qualify. When prices rise faster than incomes, the affordability index goes down and visa-versa.

Buyers who earn the reported median income of $54,578 can qualify to buy a home from the 4,441 homes in Seminole or Orange counties priced at $317,947 or less. First time buyers who earn the reported median income of $37,235 can qualify for homes in those counties priced at $192,786 or less.

Orlando Unemployment

The latest numbers for Orlando Florida – for October is 7.9%, down from September’s 8.3%. A year ago it was 9.8%. We are still above the current national average of 7.7%.

WE APPRECIATE YOUR REFERRALS!

The statistics cited is provided by the Orlando Regional Realtors Association, of which we are a member.

This report is intended to be for reference and informational purposes only. The opinions expressed herein are solely those of New Southern Properties Inc. and are opinions. No purchases or investments should be made based solely on this report, this data, or the opinions expressed herein. Real Estate purchases and investments are complex transactions. You are strongly urged to consult with your financial, legal and real estate consultants before making any real estate purchase or investment.

- New Listing Alerts

- Foreclosure and hot deals

- Market value of your home

- Excellent rates on mortgages

Florida Luxury Gated Communities

Alaqua Country ClubAlaqua Lakes Golf | Alaqua Lakes Golf Course | Alaqua Lakes Florida | Alaqua Lakes Country Club

The Preserve at Astor Farms

Baker's Crossing

Banyon Pointe

Barclay Place At Heathrow

Berington Club

Brentwood Club

Brookhaven Manor and Brookhaven Ridge

Buckingham Estates

Burlington Oaks

Calabria Cove

Capri Cove

Carrisbrooke

Coventry At Heathrow Florida

Dakotas

Debarry Golf and Country

Dunwoody Commons

Egret's Landing

Estates at Wekiva Park

Fountainhead

Grande Oaks at Heathrow

Fountain Parke

Greystone

Heathrow

Heathrow Woods

Heron Ridge

Keenwicke

Kentford Garden

Lake Forest

Lake Markham Preserve

Lakeside

Lansdowne

Magnolia Plantation

Markham Estates

Markham Forest

Markham Woods Enclave

Oregon Trace

Reserve At Heathrow

Retreat at Wekiva

River Crest

Riviera Bella

Savannah Park at Heathrow

Stonebridge

Summer Oaks

Terracina At Lake Forest

Terra Oaks

The Cove

The Retreat At Twin Lakes

Tuscany At Lake Mary

Waters Edge

Wilson Park

Wingfield North

Woodbridge Lakes

Florida Communities

Arbor RidgeArlington Park

Antigua Bay

Barrington

Bear Lake Woods

Breckenridge Heights

Celery Estates

Celery Lakes

Celery Key

Chase Groves

Chelsea Place

Country Club Oaks

Coventry

Country Downs

The Crossings

Crystal Lake Estates

Danbury Mill

Eagle Creek

The Forest

Hidden Cove

The Hills of Lake Mary

Groveview Village

Huntington Ridge, Huntington Landing, Huntington Pointe

Isle of Windsor

Kaywood

Lakewood Ranches

Live Oak Reserve

Mandarin

Markham Glen

Markham Meadows

Markham Place

Manderley

Mayfair Club

Mayfair Meadows

Mayfair Oaks

Middleton Oaks

Misty Oaks

North Cove

Northampton

Oak Island

Oceanside Village

The Pelican

Osprey Pointe

Preserve At Lake Monroe

Parkview and Parkview Heights

Ravensbrook

The Reserve At DeBary

Reserve At Golden Isle

The Reserve At Lake Mary

Ridge Pointe Cove

Shannon Downs

Springhurst

Springview

Sun Oaks

Sweetwater Oaks

Sylvan Lake Reserve

Tall Trees

The Estates At Springs Landing

Timacuan

Timacuan Park - Lake Mary Florida

Turnberry

Wingfield Reserve

Woodbine

Recent Articles

Recent Articles Recent Articles

Recent Articles Recent Articles

Recent Articles