Orlando Florida Regional Housing Market Update September 2012

ORLANDO FLORIDA REGIONAL HOUSING MARKET UPDATE

September 2012

The latest housing market data are in for Central Florida, including Lake Mary Florida, Longwood Florida, Sanford Florida, Winter Springs Florida, Oviedo Florida and Altamonte Springs Florida. Here are the highlights taken from the Orlando Realtor Regional Board for

August 2012 (the latest now available):

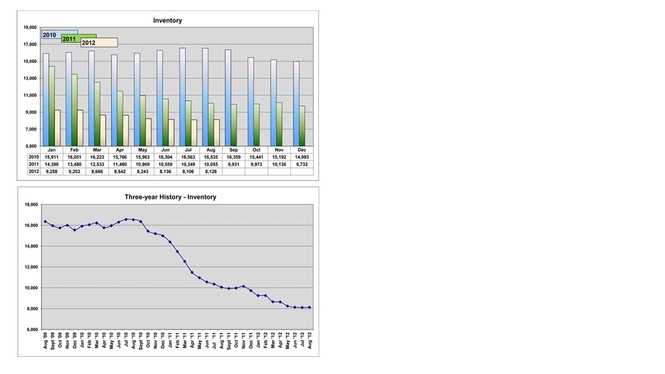

Inventory

Net overall inventory actually increased this past month - by 22 units – statistically unchanged. However, this does finally snap the record 22 months of actual decline. Twenty-two out of the last 25 months has seen Orlando Florida’s housing inventory decline. Currently there are now only 8,128 housing units on the market through the Orlando Regional Multiple Listing Service - down from 9,258 in January of this year and up from 8,106 last month. This includes single family homes, condos, duplexes and townhomes. Last August held an inventory of 10,055. In December of 2008, there were 22,524 on the market. At the very height of inventory in early 2007, there were more than 28,000 homes on the market. The overall inventory is down 19.16% from a year ago.

Single family inventory is down 23.96% from a year ago. The current pace of sales equates to only 3.09 months of supply. Inventory hasn’t been this low since 2005. Six months of supply is generally considered balanced. Under normal conditions, anything above six months is generally considered a buyer’s market and anything below is then considered a seller’s market.

Sales

There were 2,634 in August, a 5.36% increase over last August and a 10.59% hike over last month.

Of the sales in August, 1,265 or 48.03% were “normal”, 610 were short sales and 759 were bank-owned. This continues the trend of normal sales increasingly taking more and more of the sales total than those sales under distressed conditions.

Single Family Home sales increased by 6.03% over a year ago. Condo sales increased by almost 5%. As has been true since 2009 the $1-$50,000 price category leads the pack in condo sales. Two hundred fifty-six duplex, townhome and villa sales occurred in August – an increase of 1.59% over a year ago. As with last month; Most fell within the $100,000 - $120,000 price range.

Homes spent an average of 80 days on the market in August, two days less than last month and exactly three weeks less than a year ago. The average home sold for 96.26% of its then-current listing price. “Then current listing price” is an important distinction since a home may have been on the market with prior price reductions. Thus, it may have ended up selling for less than the percentage cited from its original debut listing price.

By county in the Orlando MSA for sales compared to a year ago: Seminole County was up 8.64% from last August, Orange County was up 8.3%. Osceola came in up 4.88%, and Lake County increased by 9.41%.No statistics for Volusia or Brevard were made available (Volusia has several different realtor boards with both New Smyrna and Daytona each having their own and Volusia is officially part of the Daytona Beach MSA. In addition, Brevard has its own Board).

IF YOU ARE LOOKING TO BUY OR SELL YOUR HOME OR PROPERTY – PLEASE CONTACT US AND FIND OUT HOW WE CAN HELP!

Prices

The median price of an existing home was up 5.1% in August 2012 from a year ago to $120,550. However, this is a drop from last month. This is an expected seasonal drop and a normal occurence just prior to school starting. This is an increase of 11.62% since January of this year and more than 30% since January 2011.

However, remember - the median price above encompasses all sales. Individual categories can fluctuate within the median. However, this month, as was the case last month, prices rose in all categories. Normal sales rose 2.8%, short sales rose 19.05% and Bank-Owned averages increased 4.71%.

Affordability

The Orlando MSA affordability index increased to 253 and the first time homebuyer’s index also decreased to 180, more than twenty points lower than it was 90 day ago.

This had been see-sawing backing and forth for some time, but is now trending downward as prices continue to increase. Each index is inversely proportional to pricing changes.

An affordability index of 100 means that a buyer earning the state-reported median income has exactly the income necessary to purchase the median-priced home. Anything over 100 indicates that buyers have more income than that which is required. A score of 99 means the buyer is 1 percent short of the income necessary to qualify. When prices rise faster than incomes, the affordability index goes down and visa-versa.

Orlando Unemployment

The latest numbers for Orlando Florida – for July is 9.1% up from June’s 8.6% which was up from May’s 8.3% - but down from 10.1% a year ago. The national average in July was 8.2%.

WE APPRECIATE YOUR REFERRALS!

Other News

FTC Wins in Infomercial Housing Scam. The FTC was awarded a $472 million judgment against three real estate infomercial makers. The products marketed included: “John Beck’s Free & Clear Real Estate System”.

Medical Debt Bill Could Improve Scores. A bill working its way through Congress would require credit companies to remove unpaid medical bills within 45 days of being satisfied – versus affecting a credit score for years as it is now. It passed in the House but the Senate has so far failed to take it up.

Court Rules Chinese Firm Must Pay. A Miami judge ruled against Taishan Gypsum Company for drywall defects and for homebuilder Lennar Corporation. Damages are estimated at $600 million to $1 billion.

Bank Owned Inventory Drops Significantly From A Year Ago. The number of foreclosed homes on banks’ balance sheets is down 18% from a year ago.

WE APPRECIATE YOUR REFERRALS!

The statistics cited is provided by the Orlando Regional Realtors Association, of which we are a member.

This report is intended to be for reference and informational purposes only. The opinions expressed herein are solely those of New Southern Properties Inc. and are opinions. No purchases or investments should be made based solely on this report, this data, or the opinions expressed herein. Real Estate purchases and investments are complex transactions. You are strongly urged to consult with your financial, legal and real estate consultants before making any real estate purchase or investment.

- New Listing Alerts

- Foreclosure and hot deals

- Market value of your home

- Excellent rates on mortgages

Florida Luxury Gated Communities

Alaqua Country ClubAlaqua Lakes Golf | Alaqua Lakes Golf Course | Alaqua Lakes Florida | Alaqua Lakes Country Club

The Preserve at Astor Farms

Baker's Crossing

Banyon Pointe

Barclay Place At Heathrow

Berington Club

Brentwood Club

Brookhaven Manor and Brookhaven Ridge

Buckingham Estates

Burlington Oaks

Calabria Cove

Capri Cove

Carrisbrooke

Coventry At Heathrow Florida

Dakotas

Debarry Golf and Country

Dunwoody Commons

Egret's Landing

Estates at Wekiva Park

Fountainhead

Grande Oaks at Heathrow

Fountain Parke

Greystone

Heathrow

Heathrow Woods

Heron Ridge

Keenwicke

Kentford Garden

Lake Forest

Lake Markham Preserve

Lakeside

Lansdowne

Magnolia Plantation

Markham Estates

Markham Forest

Markham Woods Enclave

Oregon Trace

Reserve At Heathrow

Retreat at Wekiva

River Crest

Riviera Bella

Savannah Park at Heathrow

Stonebridge

Summer Oaks

Terracina At Lake Forest

Terra Oaks

The Cove

The Retreat At Twin Lakes

Tuscany At Lake Mary

Waters Edge

Wilson Park

Wingfield North

Woodbridge Lakes

Florida Communities

Arbor RidgeArlington Park

Antigua Bay

Barrington

Bear Lake Woods

Breckenridge Heights

Celery Estates

Celery Lakes

Celery Key

Chase Groves

Chelsea Place

Country Club Oaks

Coventry

Country Downs

The Crossings

Crystal Lake Estates

Danbury Mill

Eagle Creek

The Forest

Hidden Cove

The Hills of Lake Mary

Groveview Village

Huntington Ridge, Huntington Landing, Huntington Pointe

Isle of Windsor

Kaywood

Lakewood Ranches

Live Oak Reserve

Mandarin

Markham Glen

Markham Meadows

Markham Place

Manderley

Mayfair Club

Mayfair Meadows

Mayfair Oaks

Middleton Oaks

Misty Oaks

North Cove

Northampton

Oak Island

Oceanside Village

The Pelican

Osprey Pointe

Preserve At Lake Monroe

Parkview and Parkview Heights

Ravensbrook

The Reserve At DeBary

Reserve At Golden Isle

The Reserve At Lake Mary

Ridge Pointe Cove

Shannon Downs

Springhurst

Springview

Sun Oaks

Sweetwater Oaks

Sylvan Lake Reserve

Tall Trees

The Estates At Springs Landing

Timacuan

Timacuan Park - Lake Mary Florida

Turnberry

Wingfield Reserve

Woodbine

Recent Articles

Recent Articles Recent Articles

Recent Articles Recent Articles

Recent Articles